Mortgage and landlord possession statistics: July to September 2025

Published 13 November 2025

Applies to England and Wales

1. Main Points

This publication presents quarterly mortgage and landlord possession statistics up to July to September 2025. In general, we have compared figures to the same quarter in the previous year. Should users wish to compare against previous years, they can do so using the accompanying statistical tables. For technical detail, please refer to the accompanying supporting document published alongside each quarterly publication here: Mortgage and landlord possession statistics - GOV.UK

| Mortgage claims have decreased while all other mortgage actions have increased | Compared to the same quarter in 2024 there were decreases in mortgage possession claims from 6,527 to 6,193 (5%) and increases in orders from 4,031 to 4,840 (20%), warrants from 3,159 to 3,876 (23%) and repossessions by county court bailiffs from 876 to 1,228 (40%). |

| Landlord repossessions have increased while all other landlord possession actions have decreased | When compared to the same quarter in 2024 there were decreases in landlord possession claims from 25,402 to 23,327 (8%), orders from 19,238 to 18,283 (5%), warrants from 11,826 to 11,405 (4%). Meanwhile repossessions have increased from 7,036 to 7,641 (9%). |

| Mortgage and landlord possession claims have decreased across all regions | Decreases in both mortgage and landlord possession claims have been recorded across all regions. All types of landlord claims remained concentrated in London. |

| Median timeliness for mortgage repossessions has increased. | The median average time from claim to mortgage repossession has increased to 46.1 weeks, up from 44.0 weeks in the same period in 2024. Meanwhile, the median average time from claim to warrant has decreased to 33.1 weeks, down from 35.5 weeks in the same period in 2024. |

| Median timeliness for landlord repossessions has increased. | The median average time from claim to landlord repossession has increased to 27.4 weeks, up from 24.4 weeks in the same period in 2024. |

A data visualisation tool has also been published that provides further breakdowns in a web-based application. The tool can be found here.

For feedback related to the content of this publication and visualisation tool, please contact us at CAJS@justice.gov.uk

2. Statistician’s Comment

There have been increases in both mortgage and landlord repossession volumes when compared to the same quarter in 2024, while the number of new claims issued for both has decreased over the same period. The rise in landlord repossessions was seen across all types of landlord claims (accelerated, private, and social) alongside falls in landlord orders and warrants.

The median timeliness of landlord claims to repossessions has risen by 3 weeks when compared to the same period in 2024, continuing the general increases seen over previous quarters. Likewise, the median timeliness for mortgage claims to repossession has risen by 2.1 weeks over the same period.

3. Overview of Mortgage Possession

Mortgage possession claims have decreased while orders, warrants and repossessions continued to increase.

Compared to the same quarter in 2024, mortgage possession claims (6,193) are down 5%, mortgage orders for possession (4,840) are up 20%, warrants issued (3,876) are up 23% and repossessions (1,228) are up 40%.

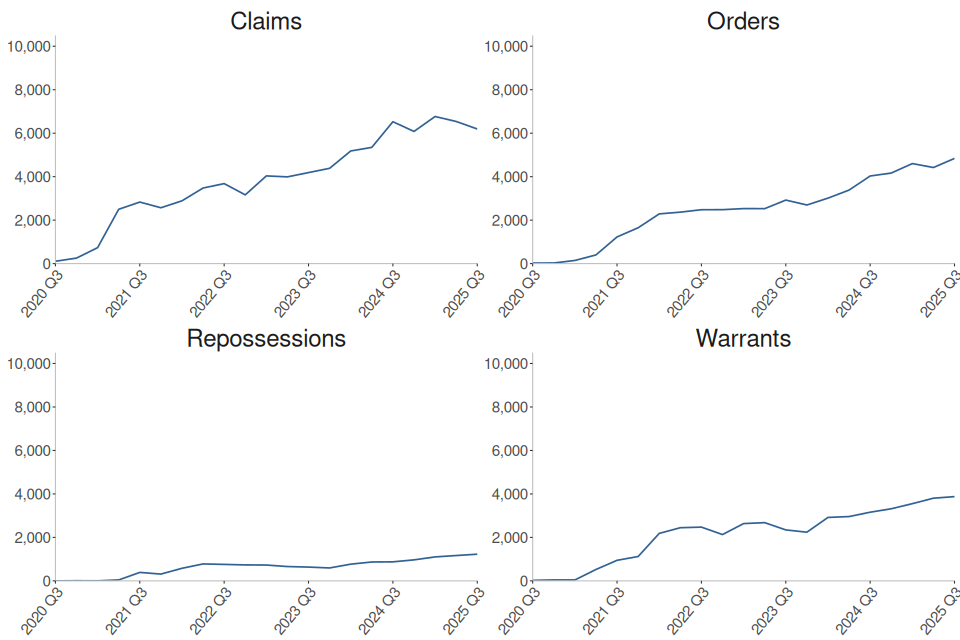

Figure 1: Mortgage possession actions in the county courts of England and Wales, July to September 2020 to July to September 2025 (Source: Table 1)

Mortgage possession claims have generally risen since Q3 2021. Orders and repossessions are now 16% and 2% above the volume in Q3 2019 respectively, whereas claims and warrant volumes are 11% and 21% below the Q3 2019 volume respectively.

Mortgage possession claims fell from a peak of 26,419 in April to June 2009 (in the aftermath of the 2008 financial crash) before stabilising in 2015 to around 5,000. In the most recent quarter, Q3 2025, there were 6,193 claims for possession, down 5% from the same quarter in 2024.

Orders and warrants for possession have followed a similar trend to mortgage claims. However, compared to the same quarter in 2024, orders are up 20% to 4,840 and warrants are up 23% to 3,876 in Q3 2025.

4. Mortgage Possession Action Timeliness

Claim to warrant median timeliness have decreased by 2.4 weeks while claim to repossession median timeliness has increased by 2.1 weeks compared to the same quarter last year. Median timeliness for claim to order has remained stable.

The median average time from claim to repossession has increased to 46.1 weeks, up from 44.0 weeks in the same period in 2024.

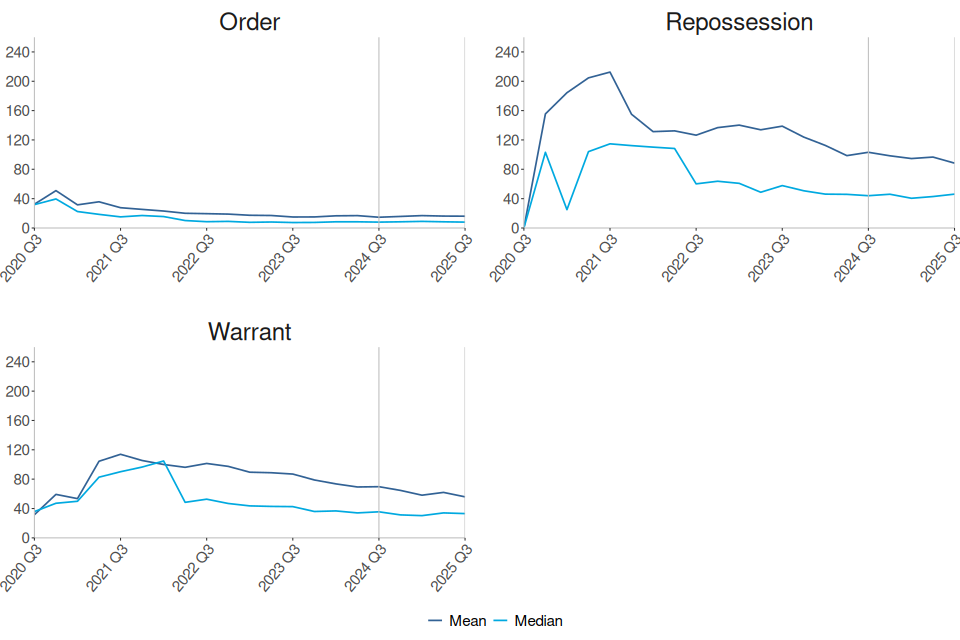

Figure 2: Average timeliness of mortgage possession actions, July to September 2020 to July to September 2025 (Source: Table 3)

Number of weeks taken from initial mortgage claim to…

Median time taken to complete mortgage actions has remained stable for claims to orders. Claims to warrants median timeliness has decreased compared to the same quarter in 2024, whereas an increase has been recorded for claims to repossession over the same period. This quarter;

-

Claims to order median timeliness is currently 8 weeks, unchanged from the same period in 2024.

-

Claims to warrant median timeliness has decreased to 33.1 weeks, down from 35.5 weeks in the same period in 2024.

-

Claims to repossession median timeliness has increased to 46.1 weeks, up from 44.0 weeks in the same period in 2024.

The trend for mortgage possession timeliness is driven by outright orders, which make up more than two thirds of all cases. In the most recent quarter, the median time taken from claim to repossession was 42.9 weeks for outright orders (an increase of 3.3 weeks), and 114.7 weeks for suspended orders (a decrease of 41.8 weeks).

The above charts distinguish between the timeliness of possession claims at different stages of a case. Average time taken from claim to warrant or claim to repossession can fluctuate and is affected by various factors. For example, the final two charts take account of the amount of time between the court order being issued and the claimant, such as the mortgage lender, applying for a warrant of possession.

Median figures are generally considerably lower than mean figures, demonstrating that progression from claim to successive stages can be positively skewed by outlying cases.

5. Overview of Landlord Possession

The number of landlord possession actions across claims, orders, and warrants have decreased compared to the same quarter of last year, whilst the number of landlord repossessions has increased.

Claims (23,327), orders (18,283), warrants (11,405) have decreased by 8%, 5%, 4%, respectively. Repossessions (7,641) have increased by 9% compared to the same quarter in 2024.

Figure 3: Landlord possession actions in the county courts of England and Wales, July to September 2020 to July to September 2025 (Source: Table 4)

Landlord possession claims showed a general increase from Q2 2021 peaking in Q3 2024 at 25,402. These have fallen overall and are currently at 23,327. Within the landlord possession actions, accelerated claims are down 15%, private landlord claims are down 6% and social landlord claims are down 3% compared to the same quarter in 2024.

In Q3 2025, 38% (8,773) of all landlord possession claims were social landlord claims, compared to 31% (7,314) private landlord claims and 31% (7,240) accelerated claims. This contrasts with pre-covid proportions when a majority of claims (around 60%) were social landlord claims.

The fall in claim and orders volumes is observed across most geographical regions. As in previous quarters, a concentration was seen in London, with 7,813 landlord claims and 6,052 landlord orders at London courts in Q3 2025, accounting for 33% each of the respective totals. In London, there was a decrease of 11% (from 8,817 in Q3 2024) for landlord claims and a decrease of 9% for landlord orders (from 6,663 in Q3 2024).

The 4% decrease in landlord warrants compared to Q3 2024, was driven by a decrease in London. Meanwhile, Wales, North West and North East both saw increases in the number of warrants over this period. The largest regional number (4,204) was again found in London, making up 37% of all landlord warrants. There was a decrease of 8% for landlord warrants in London (from 4,564 in Q3 2024).

The Housing Loss Prevention Advice Service (HLPAS) provides advice to tenants and homeowners as soon as they are served with a written notice asking them to leave their home. Individuals who require the service do not need to meet legal aid financial eligibility rules as the service is not means tested but they are required to show evidence that they are at risk of losing their home. More information can be found here.

The Renters’ Rights Act received royal assent on the 27th October 2025, and, following implementation, will change the law around rented homes in England. We will continue to monitor changes to the landlord statistics and review how the data is presented as the act is implemented. Further information on the act can be found here: Guide to the Renters’ Rights Bill - GOV.UK.

6. Landlord Possession Timeliness

Median timeliness figures for landlord orders have remained relatively stable compared to the same period of 2024 while warrant and repossession timeliness increased by 1.3 and 3 weeks respectively over the same period.

The median average time from claim to repossession has increased to 27.4 weeks, up from 24.4 weeks in the same period of 2024.

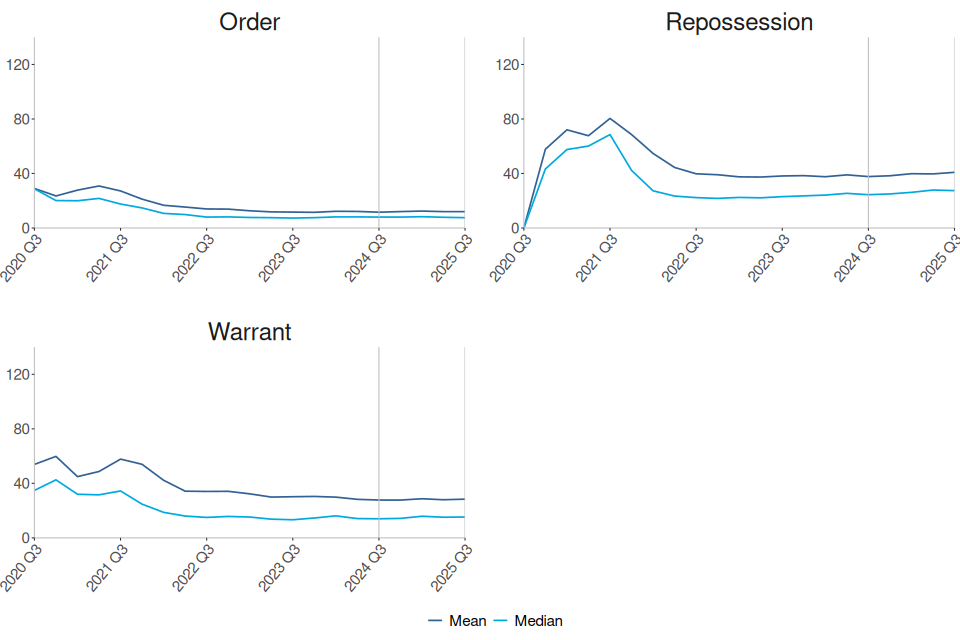

Figure 4: Average timeliness of landlord possession actions, July to September 2020 to July to September 2025 (Source: Table 6)

Number of weeks taken from initial landlord claim to…

The median time taken to complete landlord actions increased for warrants and repossessions this quarter.

-

Claims to order median timeliness is currently 7.6 weeks, down by less than a week from the same period in 2024.

-

Claims to warrant median timeliness is currently 15.3 weeks, up from 14 weeks in the same period in 2024.

-

Claims to repossessions median timeliness has increased to 27.4 weeks, up from 24.4 weeks in the same period in 2024.

As shown in Figure 4, median figures are generally considerably lower than mean figures, demonstrating that progression from claim to successive stages can be positively skewed by outlying cases.

7. Regional Possession Claims

City of London had the highest overall rate of mortgage claims at 735 per 100,000 households owned by a mortgage or loan.

Private landlord claims were highest in Barking and Dagenham with 755 per 100,000 households owned by a private landlord.

Social landlord claims were highest in Barnet with 774 per 100,000 households owned by a social landlord.

Since Q4 2022, the methodology used for calculating the rates of possession claims and repossessions has been modified to take into account the variation in proportions of tenure types in each local authority (LA) as measured by the 2021 census. More information on this change is provided in the accompanying guide to this publication here.

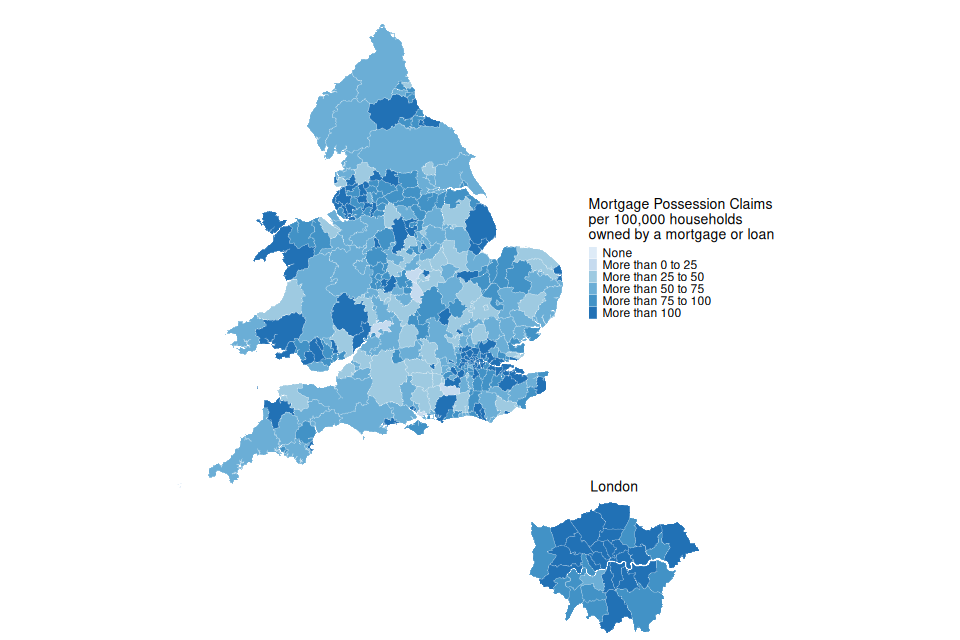

Figure 5: Mortgage possession Claims per 100,000 households owned by a mortgage or loan, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a mortgage or loan) | Actual number |

|---|---|---|

| City of London | 735 | <10 |

| Brent | 309 | 67 |

| Newham | 230 | 48 |

London boroughs accounted for 6 of the 10 local authorities with the highest rate of mortgage claims. City of London, in the London region, had the highest rate of mortgage possession claims at 735 per 100,000 households owned by mortgage or loan, followed by Brent (London region) and Newham (London region); with 309 and 230 claims per 100,000 respectively. The Isles of Scilly and the City of London have very small populations (ranked 309th and 308th out of 309 respectively for population size) therefore rates may be less robust.

1 local authority had no mortgage possession claims during this period. Excluding this Oadby and Wigston had the lowest rate of mortgage claims (13.7 per 100,000 households owned by a mortgage or loan).

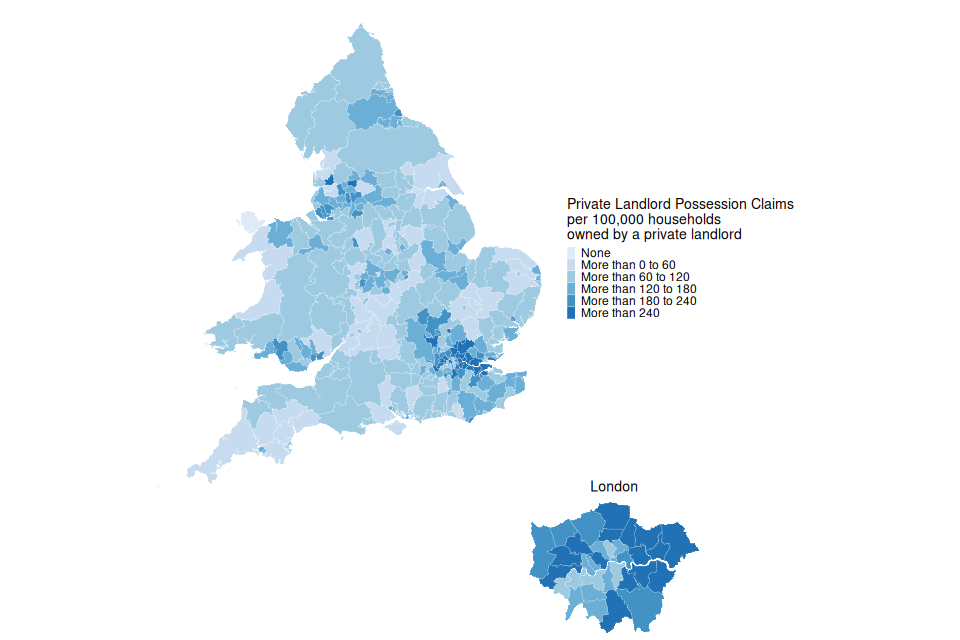

Figure 6: Private landlord possession Claims per 100,000 households owned by a private landlord, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a private landlord) | Actual number |

|---|---|---|

| Barking and Dagenham | 755 | 135 |

| Newham | 522 | 232 |

| Thurrock | 445 | 54 |

London boroughs accounted for 7 of the 10 local authorities with the highest rate of private landlord claims. Barking and Dagenham (London region) had the highest rate for private landlord claims (755 per 100,000 households owned by a private landlord), followed by Newham (London region) and Thurrock (East of England region) with 522 and 445 claims per 100,000 households owned by a private landlord respectively.

2 local authorities had no private landlord claims during this period. Excluding these, East Devon had the lowest rate of private landlord claims (9.3 per 100,000 households owned by a private landlord).

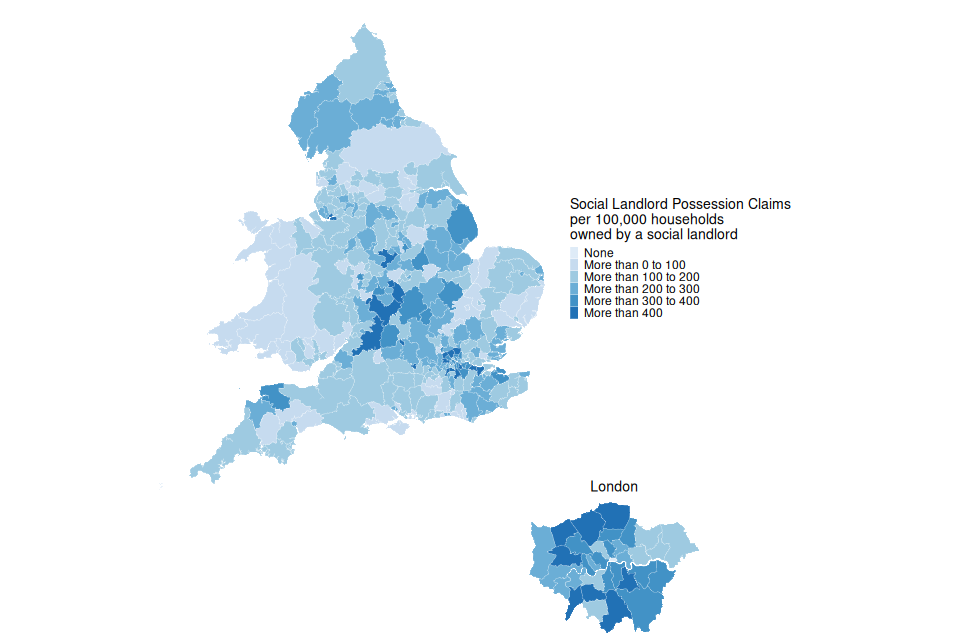

Figure 7: Social landlord possession Claims per 100,000 households owned by a social landlord, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a social landlord) | Actual number |

|---|---|---|

| Barnet | 774 | 155 |

| Kingston upon Thames | 690 | 50 |

| Nuneaton and Bedworth | 576 | 47 |

London boroughs accounted for 5 of the 10 local authorities with the highest rate of social landlord claims. Barnet (London region) had the highest social landlord possession claim rate with 774 per 100,000 households owned by a social landlord. This was followed by Kingston upon Thames (London region) and Nuneaton and Bedworth (West Midlands region) with 690 and 576 per 100,000 households owned by a social landlord respectively.

2 local authorities had no social landlord claims during this period. Excluding these, Neath Port Talbot had the lowest rate of social landlord claims (16.7 per 100,000 households owned by a social landlord).

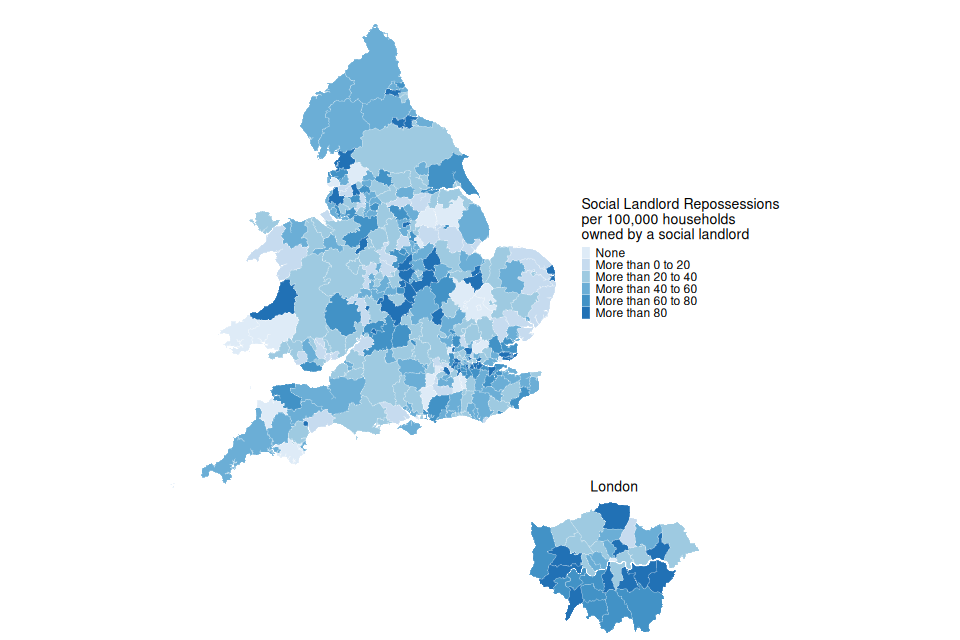

8. Regional Repossessions (by County Court Bailiffs)

Blackpool had the highest overall rate of mortgage repossessions at 71 per 100,000 households owned by a mortgage or loan.

Private landlord repossessions were highest in Newham with 304 per 100,000 households owned by a private landlord.

Social landlord repossessions were highest in Redditch with 205 per 100,000 households owned by a social landlord.

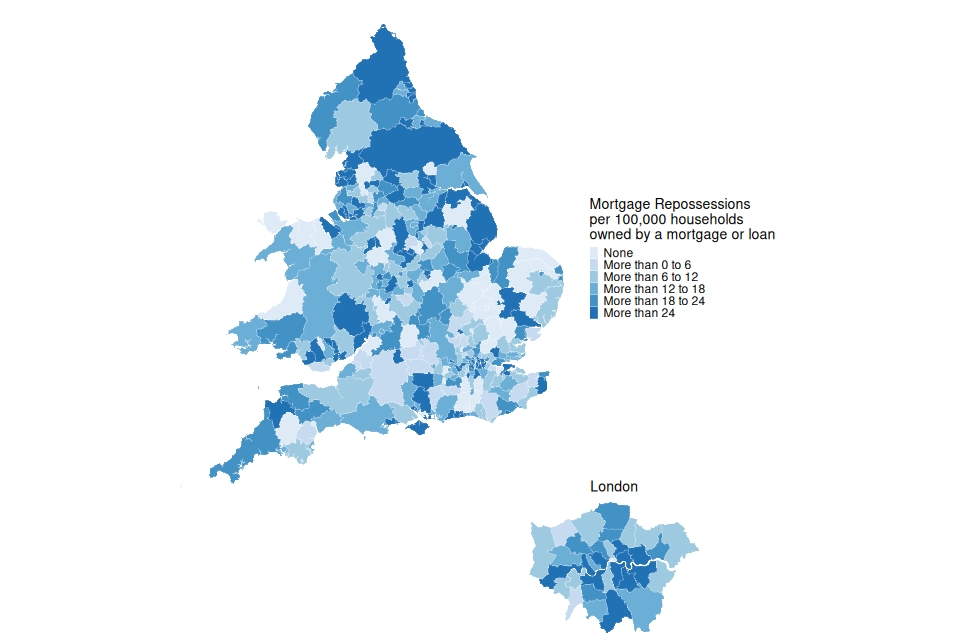

Figure 8: Mortgage repossessions per 100,000 households owned by a mortgage or loan, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a mortgage or loan) | Actual number |

|---|---|---|

| Blackpool | 71 | 12 |

| Westminster | 56 | <10 |

| Boston | 55 | <10 |

Local authorities in North East, North West, London, and Wales each account for 2 of the 10 boroughs with the highest rate of mortgage repossessions.

No repossessions by county court bailiffs were recorded during this period in 44 local authorities out of a total of 318.

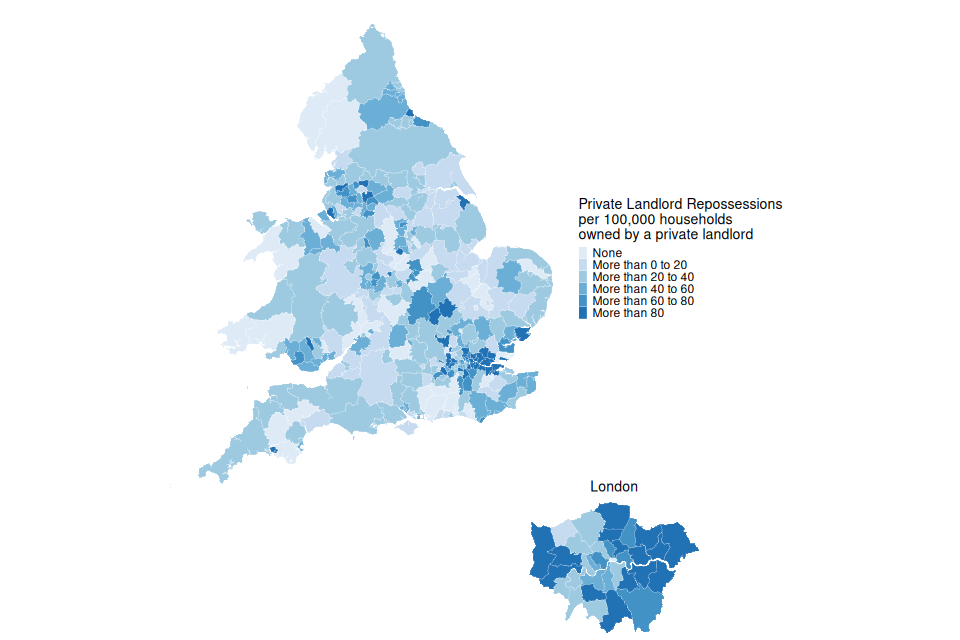

Figure 9: Private landlord repossessions per 100,000 households owned by a private landlord, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a private landlord) | Actual number |

|---|---|---|

| Newham | 304 | 135 |

| Redbridge | 266 | 84 |

| Barking and Dagenham | 235 | 42 |

London local authorities account for 6 of the 10 boroughs with the highest rate of private landlord repossessions.

39 local authorities had no private landlord repossessions by county court bailiffs in Q3 2025.

Figure 10: Social landlord repossessions per 100,000 households owned by a social landlord, July to September 2025 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a social landlord) | Actual number |

|---|---|---|

| Redditch | 205 | 15 |

| Enfield | 175 | 36 |

| Exeter | 160 | 14 |

East Midlands, West Midlands, London, South East, and South West local authorities each accounted for 2 of the 10 boroughs with the highest rate of social landlord repossessions.

25 local authorities had no social landlord repossessions by county court bailiffs in Q3 2025.

As with claims, it should be noted that for some of these areas the rates are based on a small number of repossessions.

9. Further information

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

9.1 Accompanying files

As well as this bulletin, the following products are published as part of this release:

-

A supporting guide providing further information on how the data is collected and processed, including a guide to the csv files, as well as legislation relevant to mortgage possessions and background information.

-

A set of overview tables (also available in accessible format), covering key sections of this bulletin.

-

CSV files of the map data and the possession action volumes by local authority and county court.

-

A data visualisation tool which provides a detailed view of the Mortgage and Landlord statistics. We welcome feedback on this tool to help improve it in later editions and to ensure it meets user needs.

These can be found here: https://www.gov.uk/government/statistics/mortgage-and-landlord-possession-statistics-july-to-september-2025

9.2 National Statistics status

National Statistics are accredited official statistics (https://osr.statisticsauthority.gov.uk/accredited-official-statistics/) that meet the highest standards of trustworthiness, quality and public value.

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. These accredited official statistics were independently reviewed by the Office for Statistics Regulation in September 2021. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when the standards are restored. These statistics have been audited and re-accredited as National Statistics. The most recent compliance check completed by the Office of Statistics Regulation can be found here.

9.3 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

9.4 Contact

Press enquiries should be directed to the Ministry of Housing, Communities and Local Government press office:

email: newsdesk@communities.gov.uk

Other enquiries and feedback on these statistics should be directed to the Courts and People unit of the Ministry of Justice:

Rita Kumi-Ampofo - email: CAJS@justice.gov.uk

Next update: 12 February 2026

© Crown Copyright

Produced by the Ministry of Justice